Explore web search results related to this domain and discover relevant information.

Once a token surpasses the $100,000 market cap mark, fees taper down to 0.25% for "community" coins and 0.5% for "creator" coins. Categorization of either one is dependent on the party that launched the token and the Heaven team’s discretionary review. Moreover, the other main differentiator of Heaven from other launchpads is its "God ...

Once a token surpasses the $100,000 market cap mark, fees taper down to 0.25% for "community" coins and 0.5% for "creator" coins. Categorization of either one is dependent on the party that launched the token and the Heaven team’s discretionary review. Moreover, the other main differentiator of Heaven from other launchpads is its "God Flywheel," where 100% of protocol revenue is routed towards buybacks and burns of its native token, LIGHT.Solana‑based token launchpad Heaven went live on Aug. 15 and has averaged about 4,100 token launches per day.Heaven, a Solana‑based token launchpad with its own in-house DEX, launched just over a week ago and has reached a 15% market share in terms of token launches on Solana.As the launchpad went live and activity began to pick up, LIGHT rose to an all-time high of $130 million in just a week. At the time of publication, LIGHT has a market capitalization of $33 million.

The World Gold Council's new digital framework introduces Pooled Gold Interests, allowing fractional ownership to boost liquidity and utility in the gold market.

The initiative addresses the limitations of the current market structure, which relies on either allocated gold—which involves direct ownership of specific bars but is operationally complex—or unallocated gold, which offers higher liquidity at lower costs but carries counterparty credit risk.According to data from the IndexBox platform, the global market for gold continues to see robust demand from both institutional investors and central banks, underscoring the need for more efficient trading mechanisms.We use cookies to improve your experience and for marketing.The World Gold Council, in collaboration with Linklaters and Hilltop Walk Consulting, has unveiled a new framework aimed at modernizing the global gold market.

Gold extends gains as NFP approaches, driven by rate cut expectations, ETF inflows, & geopolitical risks.

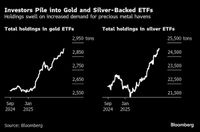

Gold prices have extended their weekly gains to 3.5% and also a seventh successive green trading day. With bond yields rising and interest rate cuts coming, market participants are facing a host of uncertainties.Market participants have been putting a lot of money into exchange-traded funds (ETFs) that are backed by gold. The SPDR Gold Trust GLD, which is the biggest gold ETF, reported that its gold holdings have gone up to 977.68 tons.If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please refer to the MarketPulse Terms of Use.He has spent the last 3 years in an analyst role honing his skills across various financial domains, including technical analysis, economic data interpretation, price action strategies, and analyzing the geopolitical impacts on global markets.

Stocks slumped as bonds got dumped yesterday. But gold and silver surged again, with the former hitting a record high. We’re seeing a similar – though more muted – dynamic today. Crude oil and the dollar are modestly lower.

Get an edge on the markets with our three-times-a-week trading newsletter, Trading Insights. Receive timely trade ideas covering stocks, options, futures, and more to keep you on the right side of the action.What’s behind the global bond market rout? Governments are buried in debt and either unable or unwilling to implement policies that would fix the problem.

Being a trader has always been impactful in my life and I wish to share the knowledge I have acquired with the world to bless as many lives as I can reach

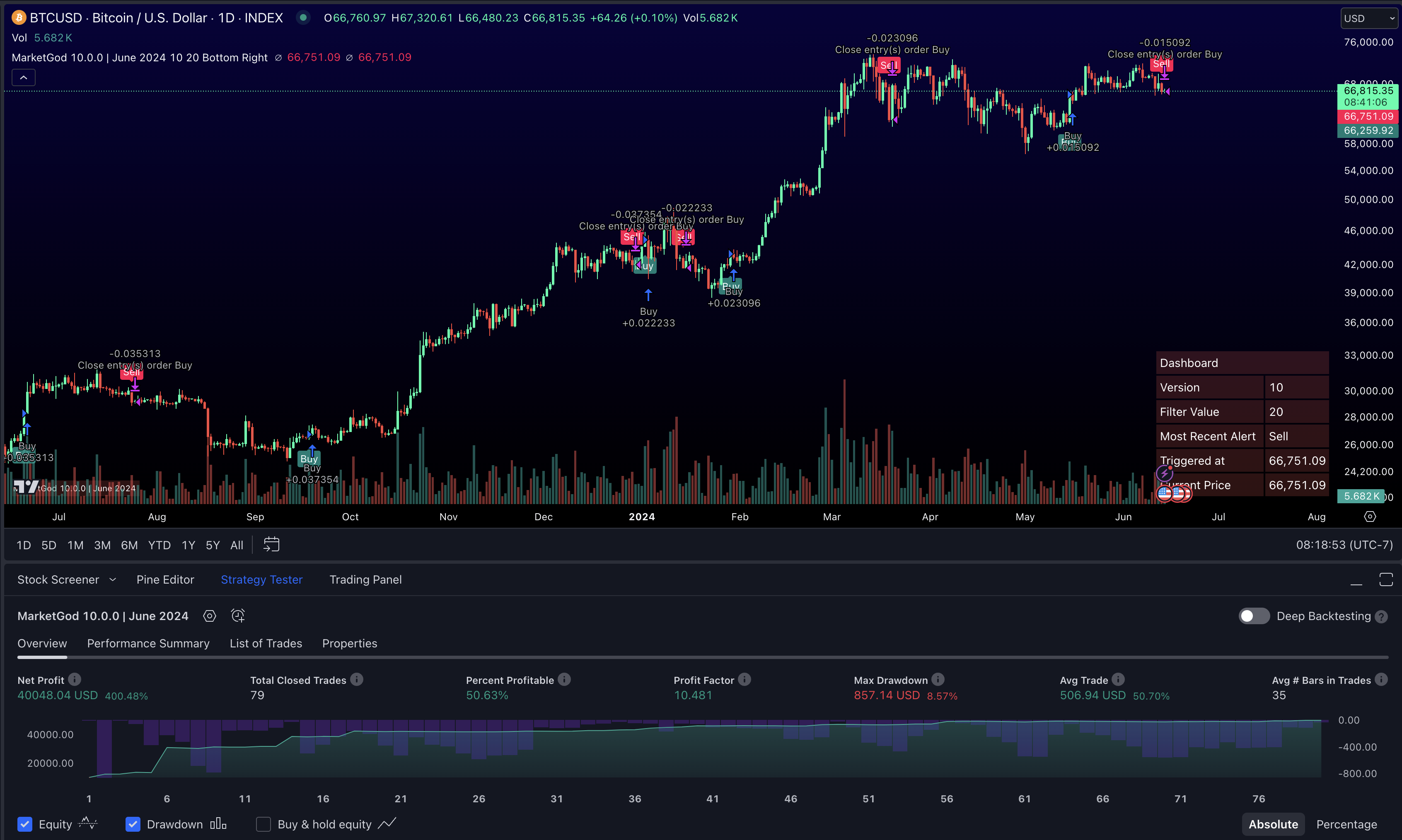

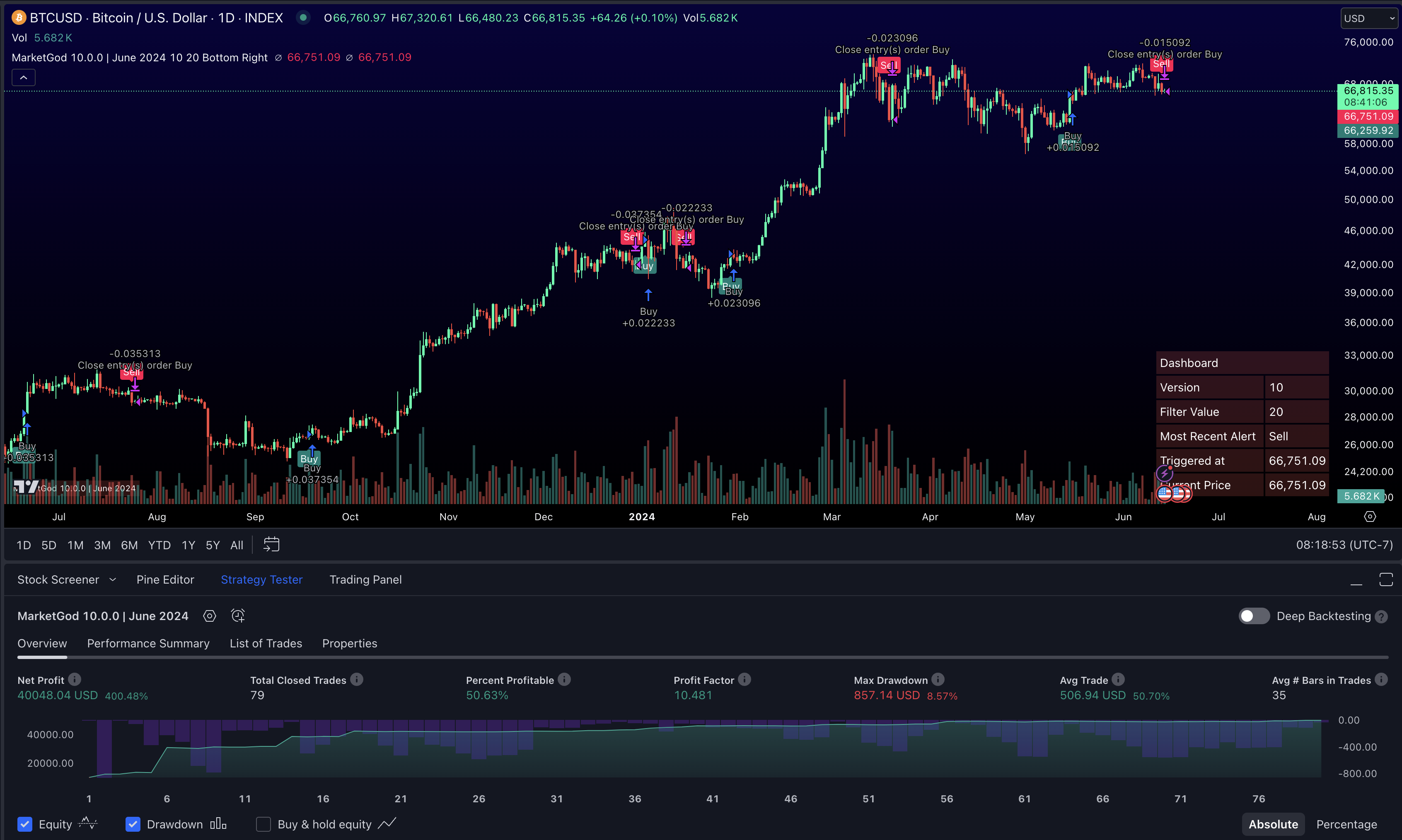

MarketGod Access | Buy and Sell Alerts for TradingView

MarketGod is a premium TradingView indicator offering buy and sell alerts for crypto, stocks, and forex traders. Enhance your trading strategy with precision signals.

The MarketGod Indicator delivers clear buy and sell signals optimized for day trading, crypto, and forex markets. These real-time alerts are algorithmically generated to help traders capitalize on price reversals and breakouts.MarketGod’s proprietary trend detection algorithm identifies bullish and bearish market trends before they fully develop. This gives crypto and forex traders a critical edge when entering or exiting positions.Stay on top of the markets with custom alerts delivered to your phone or desktop via TradingView’s native notification system. Set alerts for buy/sell signals, trend shifts, or key level breaches in real time.MarketGod is optimized for use as an overlay on price charts, maintaining a clean and uncluttered visual workspace. This is especially helpful for fast-paced day trading in crypto and forex, where chart clarity is crucial.

MarketGod is a premium TradingView indicator offering buy and sell alerts for crypto, stocks, and forex traders. Enhance your trading strategy with precision signals.

MarketGod Buy and Sell Alerts for Tradingview provide real time signals for traders of all markets, complimenting all trading styles and strategies.Supercharge your trading strategy with MarketGod Buy and Sell Alerts for Tradingview.Users can set TradingView alerts tied to MarketGod signals—so they’re notified instantly when action is needed.MarketGod is time frame optimized by design, meaning it adapts well across different trading styles—scalping, day trading, swing trading, or long-term investing.

Gold traded at a record high midafternoon on Wednesday, topping US$3,600 an ounce for the first time as traders bet on a Federal Reserve rate cut and safe-haven buying rises amid stagflation...

Markets · Equities · Top Capitalization · United States · North America · Europe · Asia · Middle East · Sector Research · Company calendar · Equities Analysis · Most popular · AMD (ADVANCED MICRO DEVICES) TESLA, INC. ALIBABA GROUP HOLDING LIMITED ·Capital Markets Transactions · New Contracts · Profit Warnings · Appointments · Press Releases · Security Transactions · Earnings reports · New markets · New products · Corporate strategies · Legal risks · Share buybacks · Mergers and acquisitions ·

Shiba Inu has been clinging tight to its long-term support near $0.00001159, and the way price keeps grinding at this base has traders whispering about the

It’s the kind of zone where markets either slide slowly into a deeper decline… or rip straight out in one oversized move that people remember for years. Traders are calling that moment the “God candle,” and SHIB may be sitting right on the edge of one.The post God Candle Incoming? Why Shiba Inu (SHIB) Could Shock the Market With a Huge Rally first appeared on BlockNews.Read the article at BlockNewsShiba Inu has been clinging tight to its long-term support near $0.00001159, and the way price keeps grinding at this base has traders whispering about the possibility of a so-called “God candle.” Every dip into this zone gets snapped up fast, leaving behind what looks like a boring floor, but it’s one that’s stubbornly refusing to crack.While price drifts sideways—or even a bit lower—the indicator is slowly creeping higher. That mismatch usually hints buyers are quietly loading up while sellers lose steam. When that happens on a defended base, sometimes the market just flips into a vertical breakout with no warning.

Japanese bond yields soar, China services strong. European stocks recover. Gold hits new record. DAX outlook.

Gold prices continued to set new records on Wednesday. This is happening because of ongoing uncertainty in the financial markets and because many investors believe that America's central bank, the Federal Reserve, will cut interest rates this month.If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please refer to the MarketPulse Terms of Use.He has spent the last 3 years in an analyst role honing his skills across various financial domains, including technical analysis, economic data interpretation, price action strategies, and analyzing the geopolitical impacts on global markets.Currently, Zain is advancing in obtaining his Capital Markets & Security Analyst (CMSA) designation through the Corporate Finance Institute (CFI), where he has completed modules in fixed income fundamentals, portfolio management fundamentals, equity market fundamentals, introduction to capital markets, and derivative fundamentals.

The Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

Our goal is to help people make informed market decisions through in-depth reporting, daily market roundups, interviews with prominent industry figures, comprehensive coverage (often exclusive) of important industry events and analyses of market-affecting developments.Kitco NEWS has a diverse team of journalists reporting on the economy, stock markets, commodities, cryptocurrencies, mining and metals with accuracy and objectivity.MarketGauge.comgoldMichele SchneiderFederal ReserveJerome PowellU.S.

Gold rose over 1% on Tuesday, surging to an all-time high above $3,500 per ounce, with investors piling into the metal on growing conviction of a Federal Reserve rate cut and lingering political and economic risks.

Attention now turns to U.S. nonfarm payrolls data on Friday for cues on the size of a September rate cut. A weak job print this week could reignite the conversation around the possibility of a 50 bps rate cut, said Zain Vawda, analyst at MarketPulse by OANDA.Markets are pricing in a nearly 92% chance of a 25 basis points cut at the Fed's September 17 meeting, according to the CME FedWatch tool, opens new tab.Jewellery is displayed at the Gold Souk market in Dubai, United Arab Emirates, March 14, 2025.Anmol reports on commodities markets, focusing on metals, energy, and agriculture.

Fully Open Source Tv Market God Strategy. Good Luck Strategy Description MarketGod can be applied to any market, with any time-frame associated to it. The signals relay the alert at the close of the period, and the painted alert is then available to users to see on the chart or even set ...

Fully Open Source Tv Market God Strategy. Good Luck Strategy Description MarketGod can be applied to any market, with any time-frame associated to it. The signals relay the alert at the close of the period, and the painted alert is then available to users to see on the chart or even set notifications for via tradingview's alert system.MarketGod Versioning The versions included with this release are the following MarketGod v1 MarketGod v2 MarketGod v3 MarketGod v4 MarketGod v5 MarketGod v6 MarketGod v7 MarketGod v8 MarketGodx² Ichimoku God Suggested Uses • MarketGod will inevitably produce false positives.We've taken steps to reduce this but we highly suggest you add this as a component of your strategy, not an end all be all • That said, please do not feel the need to fire a trade based solely on a marketgod signal, or to every signal it fires.• MarketGod users should backtest their strategy using OHLC candles for best results • Heikin Ashi candles were recomended in the past, and we have eliminated the need for them, meaning that traditional candlestick inputs will yield the highest results. • MarketGod will always give stronger alerts on higher TF's.

Joining the Market God Mentorship under Eyram Dela has been one of the most transformative decisions of my professional journey. Over the past year, the mentorship has not only sharpened my trading strategy but also reshaped my entire approach to financial markets.

Through his guidance, I’ve developed confidence in my decisions, increased my profitability, and most importantly, adopted a mindset that prioritizes growth over quick wins. I am truly grateful to be part of the Market God community—it has elevated not only my trading, but my thinking as well.The best online forex academy in AFRICA, specialised in trading GOLDThis program was more than just skill-building; it was a complete transformation of my market mindset. With newfound emotional control and smarter strategic planning, I've seen my performance soar, bringing a real sense of accomplishment. Today, I'm thrilled to say that I'm doing great in my trading career, experiencing consistent growth and confidence.Marketgod's Forex Trading Course - Lifetime access, 1 Year Mentorship!

This work employs John Dewey's cultural naturalism to explore how and why the orthodox economic tradition functions as a religious faith.Scholars such as the theologian Harvey Cox and others now view orthodox economic practice as a religion. Other scholars such as Max Weber, Alasdair MacIntyre, ...

This work employs John Dewey's cultural naturalism to explore how and why the orthodox economic tradition functions as a religious faith.Scholars such as the theologian Harvey Cox and others now view orthodox economic practice as a religion. Other scholars such as Max Weber, Alasdair MacIntyre, and numerous others view modern economic practice as exemplifying a particular ethic. The focus in this work is placed upon the destructive consequences of practicing the Market faith.

Agnico Eagle Mines Surges 90% YTD Outpacing Gold ETF as Earnings and Sector Momentum Secure 212th Market Activity Rank

The stock’s Earnings ESP of +4.87% suggests a high likelihood of another earnings beat in late October. Rising buying pressure and a strong earnings revision trend underscore investor confidence. However, market volatility and broader economic uncertainties remain potential headwinds.On September 3, 2025, Agnico Eagle Mines (AEM) closed with a 0.70% gain, trading at a volume of $0.48 billion, down 40.2% from the prior day, ranking 212th in market activity.Analysts highlight AEM’s position in the top 36% of Zacks-ranked industries, with the gold mining sector poised to outperform due to favorable macroeconomic conditions. Gold’s strength is attributed to the U.S. dollar’s 11% decline in H1 2025 and anticipation of Fed rate cuts. AEM’s operational expansion, including the Kittila project and strategic acquisitions, has bolstered its market leadership.- Analysts cite favorable macroeconomic conditions, including a weaker U.S. dollar and Fed rate cut expectations, boosting gold and AEM’s market position.

The lexicon of The Wall Street Journal and the business sections of Time and Newsweek turned out to bear a striking resemblance to Genesis, the Epistle to the Romans, and Saint Augustine's City of God. Behind descriptions of market reforms, monetary policy, and the convolutions of the Dow, ...

The lexicon of The Wall Street Journal and the business sections of Time and Newsweek turned out to bear a striking resemblance to Genesis, the Epistle to the Romans, and Saint Augustine's City of God. Behind descriptions of market reforms, monetary policy, and the convolutions of the Dow, I gradually made out the pieces of a grand narrative about the inner meaning of human history, why things had gone wrong, and how to put them right.The East Asian financial panics, the Russian debt repudiations, the Brazilian economic turmoil, and the U.S. stock market's $1.5 trillion "correction" momentarily shook belief in the new dispensation. But faith is strengthened by adversity, and the Market God is emerging renewed from its trial by financial "contagion." Since the argument from design no longer proves its existence, it is fast becoming a postmodern deity—believed in despite the evidence.At the apex of any theological system, of course, is its doctrine of God. In the new theology this celestial pinnacle is occupied by The Market, which I capitalize to signify both the mystery that enshrouds it and the reverence it inspires in business folk. Different faiths have, of course, different views of the divine attributes.As I tried to follow the arguments and explanations of the economist-theologians who justify The Market's ways to men, I spotted the same dialectics I have grown fond of in the many years I have pondered the Thomists, the Calvinists, and the various schools of modern religious thought. In particular, the econologians' rhetoric resembles what is sometimes called "process theology," a relatively contemporary trend influenced by the philosophy of Alfred North Whitehead. In this school although God wills to possess the classic attributes, He does not yet possess them in full, but is definitely moving in that direction.

The price of gold hit a fresh record on Wednesday amid a weak U.S. dollar and a firming belief the Fed will cut rates

The price of gold has risen roughly 20 per cent over the last six months and 40 per cent since September 2024. It reached its previous all-time high of US$3,500 per ounce on April 22, following a stock market slump after U.S.Since then, concerns over the Fed’s independence have continued to grow, as Trump is embroiled in an attempt to fire governor Lisa Cook from her role. Spooked investors are now pushing gold’s spot price to new levels on expectations of a 25-basis-point rate cut at the central bank’s next meeting on Sept. 17 — the likelihood of which the market puts at 91 per cent, according to the CME FedWatch tool.The gold market is too important to be left to private clubs

Prices have advanced about 6% over the past seven sessions, underpinned by increased haven demand amid renewed worries over the Federal Reserve’s future and concerns about sovereign debt levels in developed-world countries. Gold has risen more than a third this year, making it one of the ...

Prices have advanced about 6% over the past seven sessions, underpinned by increased haven demand amid renewed worries over the Federal Reserve’s future and concerns about sovereign debt levels in developed-world countries. Gold has risen more than a third this year, making it one of the best-performing major commodities.The latest run has been propelled by expectations the US central bank will lower rates this month, after Fed Chair Jerome Powell cautiously opened the door to a cut. A key US jobs report this Friday is likely to show signs of an increasingly subdued labor market, supporting the case for rate cuts.Silver is also valued for its industrial uses in clean-energy technologies, including solar panels. Against that backdrop, the market is headed for a fifth year of deficits, according to the Silver Institute.Investors have piled into silver-backed exchange-traded funds, with holdings expanding for a seventh consecutive month in August. That’s drawn down stockpiles of freely available metal in London, leading to persistent tightness in the market.